HPN Conduit

Overview

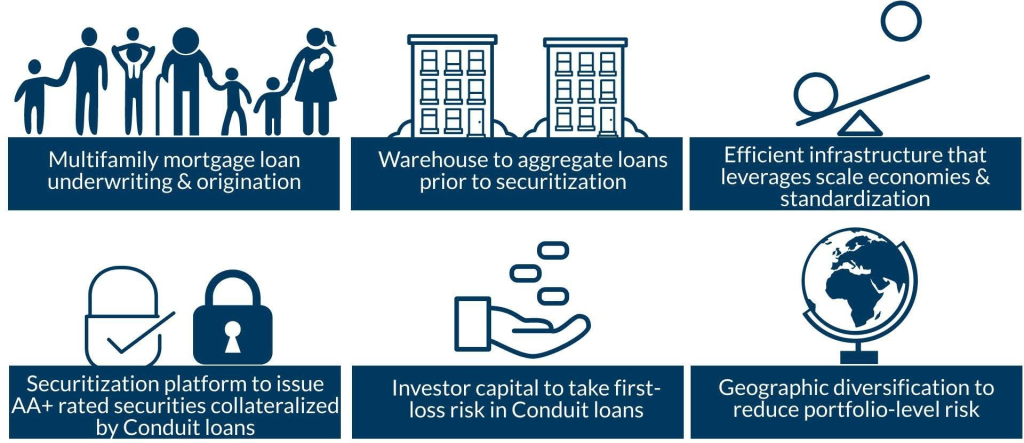

The HPN Conduit (the Conduit) will attract and channel long-term capital from institutional investors to finance nonprofit developers’ affordable housing efforts. By providing capital to finance multifamily projects on a large, aggregated scale, the Conduit brings multiple advantages as compared to standard financing options. Conduit participants will benefit from more flexible credit terms, greater borrowing proceeds, improved cash flow and, for refinanced loans, the opportunity to extract and redeploy otherwise trapped equity into new acquisition and development opportunities. The Conduit facilitates several essential components of the affordable housing finance system:

The Role of HPN

HPN is the strategic advisor to the Conduit, and will coordinate activities among the various business partners including HPN members, Systima Capital Management (Systima), securitization issuers, and Wall Street placement agent(s). By building on our relationships with foundations, impact investors, and other global partners, HPN will develop and expand the investor marketplace for our sponsored securitizations. HPN’s long-term goal is to drive down the cost of capital and develop investor recognition of affordable housing as an asset class on par with public utilities and other infrastructure-related public companies.

The Role of Systima

Systima is an investment manager focused on debt and equity investments in specialized housing and mortgage markets. Systima will provide advisory and other services to the Conduit including mortgage underwriting and origination, securitization structuring, and warehouse facility management. Systima also brings crucial investment capital for first-loss credit support in a capital markets securitization. Systima’s extensive experience with affordable multifamily housing finance, and their innovative approach to meeting HPN members’ financing needs, provides the Conduit with significant market power and valuable practical expertise.

Loan Products and Terms

- $1 million minimum, no maximum loan size;

- Refinancing existing properties (including year-15 LIHTC, HUD Section 202 and other assets);

- Acquiring and preserving Workforce/Naturally Occurring Affordable Housing (NOAH) properties; and

- Tenant-in-place and moderate rehabilitations.

- Fixed rate with loan terms from 5 to 20 years; amortization terms up to 40 years

For additional information on the HPN Conduit, including Term Sheets, click here to email Mike McCabe.

Capital Markets Securitization

The Conduit’s goal is to originate, warehouse and aggregate a sufficient dollar amount of loans to sponsor its own securitizations. Larger securitization deals are generally more efficient, as fixed issuance costs (such as legal, accounting, and ratings agency costs) are spread over a larger base of assets. These cost efficiencies, together with more flexible terms, translate to superior loan terms for HPN’s members.

HPN plans to utilize a capital markets securitization platform to issue AA+ rated securities collateralized entirely by Conduit loans. This approach requires the Conduit to provide third-party investor capital to purchase subordinate certificates (commonly referred to as “B-certificates”) to provide first-loss credit protection for the security’s guaranteed senior certificates (“A-certificates”). Typically, B-certificates comprise approximately 10 percent of the total securitization. Systima will be the investor in the Conduit’s B- certificates and has already raised $300 million from investors for this purpose. Because the Conduit is providing this important credit risk reduction, we are also able to provide borrowers with greater flexibility around individual loan terms.

The market for highly rated and liquid A-certificates is crowded with institutional investors, such as insurance companies, pension funds, and government agency bond investors. HPN will endeavor to expand this market further to include impact investors looking to support affordable housing finance vehicles.

As the sole sponsor of these securitization, the Conduit will develop its own credit reputation with global investors who can track the performance of the Conduit’s loans and securities against other benchmarks, eventually setting the stage for additional securitization options.

For additional information on the HPN Conduit, including Term Sheets, click here to email Mike McCabe.