Making Affordable Housing Greener, Healthier, and More Resilient

HPN created Housing Sustainability Collaborative, a forum for over 30 member organizations – both developers (multifamily and single-family) and lenders – to share their needs and feedback on how to best structure green financing opportunities for their portfolios. HSC also includes national lenders and partners who contributed to the discussion. HSC members connected virtually over many months, sharing opportunities and barriers and crafting solutions, culminating in an in-person convening on March 6th in DC.

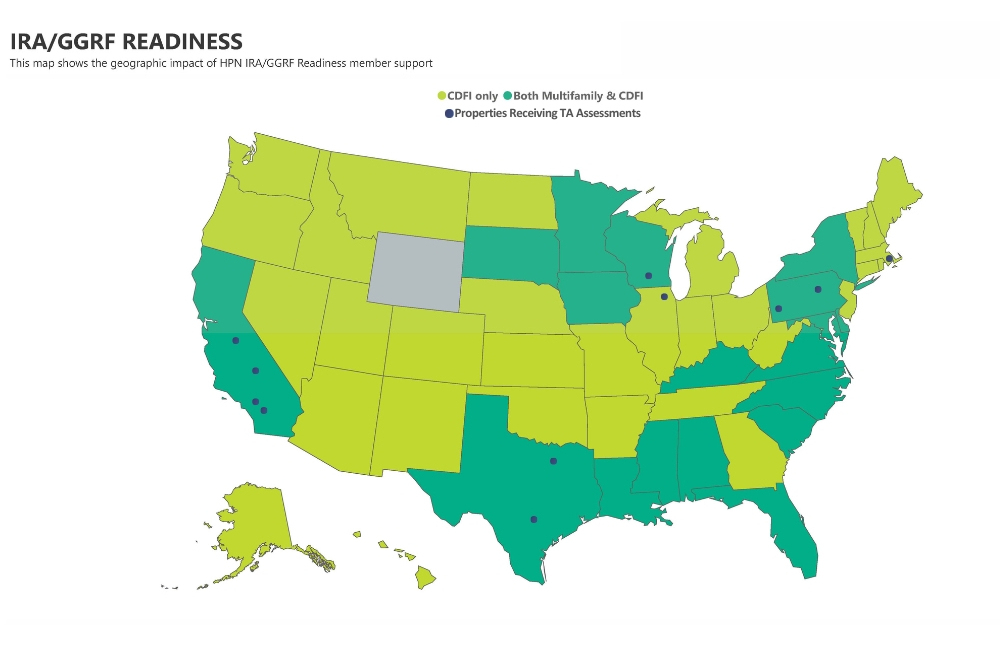

Readiness

Practitioner-led peer exchange revealed that members face readiness barriers to effectively and efficiently accessing the suite of resources for green scopes of work, including organizational capacity, market dynamics, financial constraints, and access to subject matter expertise. Even members with established decarbonization goals and experienced sustainability professionals recognize that more is needed to maximize the potential of green financing. HPN saw that members needed support to navigate the many and varied incentive programs, determine eligibility, braid and stack incentives, and build a strategy across a portfolio to optimize sequencing of decarbonization activities.

Based on learnings from the HSC, HPN designed a robust direct support strategy in the form of consultant services to ready HPN members’ property and lending portfolios. As of February 2025, we have onboarded and engaged with a network of consultants to support roughly 20 members through our three-pronged readiness approach - Multifamily, CDFI and Solar Investment Tax Credit - and direct technical assistance (TA) support. As a product of the direct support, members receive individualized reports, and consultants aggregate learnings across each area, producing deliverables such as case studies and best practices, which can be shared with members and the sector.

Focus Areas

- Multifamily Developer Pipeline Development: Supporting multifamily developer/owner members in assessing their portfolios and identifying specific properties for decarbonization project scopes with technical assistance partners.

- CDFI Pipeline Development: Developing CDFI capacity for green underwriting through reviewing portfolios to identify and develop qualified projects and assessing organizational capacity.

- Solar Investment Tax Credit: Developing tax structuring and financing strategies for several solar project typologies common among housing non-profits and CDFIs, focusing on enabling use of the Direct Pay provision to the Renewable Energy Investment Tax Credit (Solar ITC).

Geographies

Philosophy

Convener: HPN uses a collaborative engagement model to bring together practitioners who are experts in affordable housing lending and development to identify challenges and opportunities and develop solutions that work for affordable housing and the residents and communities they serve.

Influencer: HPN brings a practitioner-informed perspective to its policy and program work. HPN consults with members to inform the financing structures and resources needed to ensure the adoption of green improvements and financial structuring. HPN provided practitioner-informed feedback to sector partners, investors, and government agencies, much of which was adopted, ensuring programs work for affordable housing.

Collaborator: HPN supports our member developers and lenders to act on improvements to affordable housing to make them more energy efficient. Through peer exchange and targeted technical assistance, HPN is strengthening members’ ability implement green financing products and complete housing developments.

Contact

Reach out to Adam Meier to learn more about HPN’s work to support building and financing green, healthy and resilient affordable housing or if you have any other questions related to readiness or climate funding.